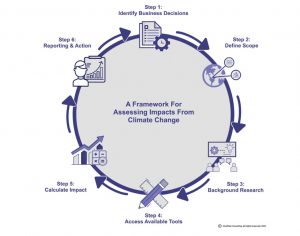

One of the main challenges for risk managers is to develop a framework that includes a robust process for assessing the impacts of specific scenarios on the organisation. The Institute of Risk Management’s SIG have reviewed a number of frameworks that are being developed to support the design of climate scenarios and we outline below a six-stage process shown in the figure below that organisations can use. Here’s a high-level summary of the main requirements that we believe are important for risk managers to consider within each of the stages.

Stage 1: Identify Business Decisions

The first phase of the process should seek to link climate issues to specific organisational threats and opportunities that will help to support business decisions and long-term strategic planning. Organisations should also endeavour to identify and understand the key drivers of their business performance and look to build these into their scenarios. In designing the scenarios it is important to understand past climate trends and losses, review the current risk profile in detail and then consider emerging climate risk trends. Scenario analysis can address multiple purposes while focusing on a range of potential stresses and scenarios, and upfront recognition of this diversity encourages the placement of appropriate design elements and controls. Scenario analysis can have important potential applications in a number of areas. For each area of use, key scenarios must be identified along with a model for analysing the impact of the scenarios. An important point is that the intended use of the analysis should drive the scenario selection and design decisions. By ensuring that objectives are identified and agreed upon upfront, a common reference point is established for communicating and interpreting results. As discussed in the design of the emerging risk radar the relevance and prioritisation of the business decisions will depend on the specific risk profile of the individual organisation and industry. Similarly, the appropriateness of the approach will vary depending on factors such as the organisation’s climate ambition, which we discuss in Section 4 of the guide. What makes climate change somewhat unique is the wide-ranging potential business impacts that will need to be considered. They can influence a range of business decisions making and regulatory requirements such as climate disclosures. A list is shown below in Figure 15 that illustrates the need to support a range of stakeholders both internal and external such as rating agencies and customers.

From an ERM perspective, one of the main business decisions will be to review and enhance the organisation’s risk appetite framework and consider both changes in new qualitative and quantitative statements and metrics relating to climate change risk.

Another key consideration will include the impact of future changes in concentration and risk aggregation exposures emanating from climate change. Existing scenario analysis applications, such as inputs within ERM regulatory-driven processes (including ORSA or ICAAP for financial services firms), will need to continue with climate change threats being an additional set of inputs required. This process is also applicable to most organisations in assessing the robustness of their solvency or capital position.

Stage 2: Define Scope

This is a critical phase of the process in which the organisation needs to consider the scope of analysis. This will depend on the nature of the business e.g. the industry and economic sectors that the organisation operates in. Climate change can affect businesses across legal entities, sectors and geographies and thus the scope of a scenario needs to be carefully thought through.

Factors considered might include: > the geographic location of the organisation’s value chain > the organisation’s assets and nature of operations > the structure and dynamics of the organisation’s supply and demand markets > the organisation’s customers > the organisation’s other key stakeholders

Significant research is therefore required to support the scoping exercise. Key design considerations are discussed in more detail in stage three.

Stage 3: Conduct background research

This stage involves a range of approaches to undertaking what is often termed a “deep dive” exercise by risk managers. Detailed research is undertaken into the design of a specific scenario which can include research into relevant previous climate-related loss events or the extrapolation of known trends. Research of future changes in weather patterns of natural catastrophic events will be an important consideration. For financial services firms, one of the key areas of focus will be to assess the potential concentration of risk exposures relating to these event types within their business.

- Climate scenario types and archetypes

- Climate Pathways

- Regulatory scenario frameworks and climate pathways

- Use of Representative Concentration Pathways (RCPs)

- Data sources and data availability

- Climate data and use of data platforms

- Global Climate Models (GCM)

Stage 4: Assess available tools

We now provide a high-level overview of some of the tools and techniques that risk managers can use but want to caveat that this just outlines some of the current methodologies available. These include some quite advanced tools for modelling physical risks, such as natural catastrophe models and hazard mapping techniques. Firms need to select appropriate impact assessment tools to analyse the change in the chosen risk metrics for a given scenario. It is important to note that whilst there are some robust tools for modelling certain risks there is an expectation that new methodologies and tools need to be developed to help organisations meet the challenges that we have outlined in relation to the uncertainties and complexities involved with modelling transition risks.

Stage 5: Calculate The Impact

With the increasing awareness of climate change risk, organisations should be seeking to introduce climate scenarios into their existing scenario analysis programmes (in order to incorporate the potential financial impacts into their financial metrics). This is facilitated further if climate risk considerations are included within their risk appetite statements and key risk indicators. An organisation should seek to measure the aggregate impact of climate scenarios into their income statements and balance sheet as well as other key financial metrics, such as risk-weighted-assets ratios or regulatory capital buffers. Defining meaningful metrics can be challenging. The metrics used in communicating the outcome of an exercise should be driven by the decision they are meant to inform, and their familiarity

Physical scenarios are often aligned to an extreme, or “tail”, event with a return period such as a 1 in a 100 year event i.e. the loss event will occur once every 100 years or have a 1% chance of occurrence in a single year. Metrics will vary by industry and business needs. As an example, insurers may choose to focus on measuring the impact of climate-related financial risks on claims and premiums that drive the profits and losses across their lines of business. Banks may need to assess how climate-related financial risks are to be factored into their measure of risk-weighted asset ratios in order to inform their capital reallocation processes. The quantification of risk may involve reviewing the credit risk profile of customers, changes in counterparty ratings, the repricing of collateral and underlying assets, etc. For example, a mortgage bank would be interested in assessing the potential impact of floods on its mortgage portfolio, quantifying physical damage with metrics that feed into the expected loss models. Likewise, a bank with an oil & gas portfolio would assess how potential carbon price movements may affect the credit risk profile of corporate borrowers and therefore the calculation of loan provisions. For smaller firms, it may be more sensible to start with one aspect of this analysis and build up expertise over time.

Stage 6: Reporting And Action

Organisations will ultimately need to describe the methodology used for selecting their scenarios – that will include the rationale for choosing the underlying assumptions for each scenario regarding how a particular pathway might develop, for example. It will be important for an organisation to disclose and discuss this information, including the sensitivity of various assumptions to changes in key parameters so that investors and other stakeholders have a clear understanding of the scenario process – not only the outcomes each scenario describes but the pathway envisioned by an organisation that leads to that outcome (i.e., the how and why of those outcomes). In terms of internal reporting, it will be important to consider developing bespoke climate risk dashboards that can be used to assess climate risk report across the short-term, medium and long-term time horizons of Boards. Communicating the quantitative and/or qualitative loss results to decision-makers is arguably the most important stage and could take the form of a recommendation to ‘act’ or ‘monitor’ based on the results presented. The results will need to include a clear indication of the extent to which loss estimates can be relied upon, and appropriate caveats will be necessary to manage the risk of misinterpretation. For instance, ‘these results are intended to illustrate loss sensitivity to climate change and do not constitute a prediction or forecast’.

Download IRM’s Climate Change Risk Management Guidance here

Get certified in Enterprise Risk Management and learn how to manage climate risks for your company.