The global order is undergoing a profound transformation as the climate crisis accelerates, exerting debilitating effects on economies, ecosystems, businesses and societies at an unprecedented pace. Unlike traditional risks, climate change manifests through both acute events—such as cyclones, floods and wildfires—and chronic trends like rising temperatures, sea-level rise and shifting precipitation patterns. These phenomena interact in complex ways, amplifying vulnerabilities and creating cascading impacts across supply chains, infrastructure networks and financial markets.

Despite the existential nature of the threat, many governments and institutions remain reactive, addressing climate impacts only after they materialise rather than embedding resilience and adaptation into strategic planning. A paradigm shift towards proactive climate risk assessment is urgently required, underpinned by robust, centralised and credible climate data repositories. Such repositories form the foundation for informed decision-making, enabling businesses to quantify, monitor and mitigate both physical and transition risks.

The Global Economic Toll of Climate Change

Acute and Chronic Impacts

According to the World Economic Forum’s Global Risks Report 2025, weather and climate-related events rank as the second-most challenging security threat—only surpassed by armed conflicts and war. Between 1993 and 2022, the Climate Risk Index reports over 9,400 extreme weather events, resulting in more than 765,000 fatalities and direct losses of nearly USD 4.2 trillion (inflation-adjusted). These figures capture only the immediate destruction; the indirect and long-term economic repercussions—such as lost productivity, infrastructure degradation and ecosystem collapse—are far greater.

Macroeconomic Consequences

Research by the US National Bureau of Economic Research (NBER) indicates that global GDP would be over 37 per cent higher today if warming between 1960 and 2019 had not occurred. The same study suggests that the economic costs of a hotter planet are likely to be at least six times greater than current estimates. Complementary findings in Nature project an additional 19 per cent decline in average global incomes by 2050 under current emissions trajectories. These macroeconomic impacts underscore the imperative for mitigation, adaptation and resilience-building.

Investor Sentiment and Infrastructure Risks

A 2024 survey by the EDHEC Infrastructure & Private Assets Research Institute found that 97 per cent of institutional investors consider climate risk significant, and 76 per cent believe it will have a medium-to-high impact on their infrastructure portfolios. Alarmingly, 76 per cent also reported insufficient access to climate data and scenarios for assessing physical risks. A disorderly transition could erode USD 600 billion of infrastructure value, with even low-carbon sectors—such as renewables and social infrastructure—vulnerable to transition and physical risks.

Climate Risks for India and Corporate India

National Vulnerabilities

India is acutely exposed to climate change, ranking sixth in the Germanwatch Global Climate Risk Index 2025 for extreme events between 1993 and 2022. Over 400 extreme events were recorded, causing more than 80,000 fatalities and economic losses exceeding USD 180 billion. The Asian Development Bank projects a potential 24.7 per cent reduction in India’s GDP by 2070, driven by rising sea levels, heatwaves and erratic monsoons. Coastal inundation alone threatens trillions of dollars in assets and endangers some 300 million residents.

Sectoral Impacts

- Agriculture: Heat stress and irregular rainfall jeopardise yields, with the World Bank estimating up to 10 per cent yield reductions in key crops by 2050.

- Manufacturing & Construction: Extreme heat can curtail labour productivity, potentially costing India USD 159 billion in lost output (5.4 per cent of GDP) in 2021 alone. The Reserve Bank of India warns that lost labour hours due to heat could put 4.5 per cent of GDP at risk by 2030.

- Infrastructure: Flooding and cyclones damage roads, ports and power grids. A single severe flood can set back regional development by years.

- Financial Services: Banks and NBFCs face credit risks as borrowers in vulnerable regions default on loans. Insurers confront mounting claims from weather-related disasters.

Regulatory Response

The Reserve Bank of India has published draft financial environmental risk disclosure rules and plans to launch a limited-scope data repository. The draft framework mandates regulated entities to outline climate risk management plans, covering governance, risk assessment, scenario analysis and disclosure. Furthermore, the RBI has urged banks and NBFCs to pool bankable climate projects, thereby catalysing financing for mitigation and adaptation.

The Imperative for Centralised, Credible Climate Data Repositories

Data Fragmentation and Its Consequences

Currently, climate data is dispersed across disparate sources—meteorological departments, satellite providers, academic studies and proprietary vendor datasets—often with inconsistent formats, varying quality and limited interoperability. This fragmentation impedes:

- Comparability: Divergent methodologies yield incompatible risk metrics.

- Timeliness: Delays in data updates hinder real-time monitoring.

- Transparency: Proprietary data may lack audit trails or clear provenance.

- Accessibility: High costs restrict access for smaller firms and developing-country stakeholders.

Without a unified repository, corporates cannot comprehensively assess business risk hotspots, calibrate scenario analyses or allocate capital effectively.

International Frameworks and Standards

Several global initiatives underscore the need for harmonised climate data:

- Task Force on Climate-related Financial Disclosures (TCFD): Advocates structured disclosure of governance, strategy, risk identification and assessment and metrics & targets, supported by scenario analysis.

- Network for Greening the Financial System (NGFS): Recommends central banks and supervisors develop climate scenarios and share data.

- ISO 14091: Provides guidelines for vulnerability, impact and risk assessment in the context of climate change adaptation.

- Global Covenant of Mayors Data Initiative: Aggregates urban climate data to inform municipal resilience planning.

A centralised repository aligned with these frameworks would standardise data definitions, ensure methodological rigour and facilitate comparability across sectors and geographies.

Designing a Robust Climate Risk Data Repository

Data Sources and Ingestion

A comprehensive repository should ingest:

- Historical Observations: Temperature, precipitation, sea-level and extreme event records from national meteorological services and global datasets (e.g., ERA5, GHCN).

- Projected Climate Scenarios: Downscaled outputs from General Circulation Models (GCMs) and Regional Climate Models (RCMs) under multiple Representative Concentration Pathways (RCPs) and Shared Socioeconomic Pathways (SSPs).

- Hazard Atlases: GIS-enabled maps of flood zones, cyclone tracks, drought indices and heatwave frequency.

- Asset Inventories: Corporate asset locations, infrastructure networks and supply-chain nodes, tagged with geospatial coordinates.

- Socioeconomic Data: Demographics, labour productivity metrics, GDP distribution and health indicators.

Data ingestion pipelines must automate extraction, transformation and loading (ETL), with version control and metadata capture to document data provenance, update frequency and quality metrics along with corporate risk strategies.

Data Quality and Validation

Ensuring data integrity requires:

- Validation Rules: Range checks, temporal consistency tests and cross-dataset reconciliation.

- Gap Filling: Statistical imputation or machine-learning-based reconstruction for missing observations.

- Bias Correction: Applying quantile mapping or delta-change methods to align model outputs with observed baselines.

- Uncertainty Quantification: Propagating uncertainties from model ensembles, parameter choices and scenario assumptions.

A transparent data quality dashboard should allow users to assess confidence levels and identify data limitations.

Data Storage and Access

- Data Lake Architecture: A centralised storage layer (e.g., cloud-based object storage) for raw and processed datasets, with support for large-scale geospatial and time-series data.

- Data Warehouse & Cubes: Optimised for analytical queries, enabling rapid retrieval of aggregated metrics (e.g., annual flood risk by state).

- APIs & SDKs: RESTful and GraphQL interfaces for programme-matic access, with language-specific software development kits (Python, R, Java) for seamless integration into risk modelling workflows.

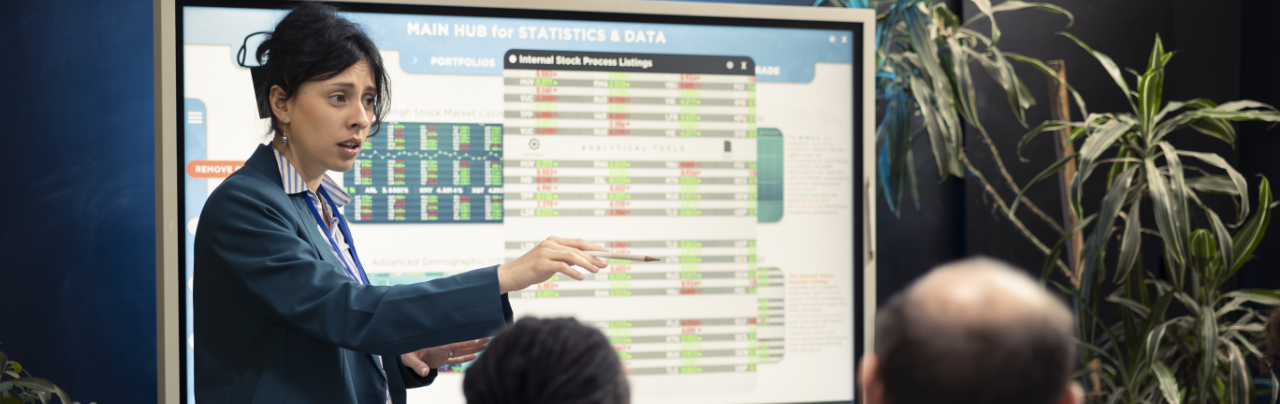

- User Interface: Web-based dashboards offering interactive maps, scenario comparison tools and custom report generation.

Role-based access controls, audit logging and encryption (at rest and in transit) are essential to safeguard data confidentiality and integrity.

Advanced Analytics and Visualisation

- Scenario Analysis Engine: Enables users to run stress-tests under multiple climate and socioeconomic pathways, assessing impacts on asset valuations, revenue streams and operational metrics.

- Machine Learning Models: Predictive models for hazard occurrence (e.g., flood forecasting), vulnerability assessments (e.g., crop yield losses) and anomaly detection in real-time sensor feeds.

- Digital Twins: Virtual replicas of critical infrastructure (e.g., ports, power plants) to simulate performance under extreme events, informing adaptation investments.

- GIS Mapping: Heatmaps of exposure, vulnerability and adaptive capacity at hyper-local resolution, facilitating targeted interventions.

These analytics empower decision-makers to translate raw data into actionable insights and quantify the cost-benefit of mitigation and adaptation measures.

Integrating Climate Data into Corporate Risk Management

Governance and Oversight

Effective integration of climate risk into ERM requires:

- Board-Level Sponsorship: Establishing a climate risk committee or integrating climate oversight within existing risk committees.

- Risk Appetite Framework: Defining qualitative and quantitative thresholds for acceptable climate exposures, aligned with strategic objectives and stakeholder expectations.

- Policies and Procedures: Embedding climate considerations into credit policies, capital allocation guidelines and procurement protocols.

Risk Identification and Assessment

- Materiality Assessment: Identifying which climate hazards pose the greatest threats to specific business lines, geographies and asset classes.

- Heatmaps and Risk Registers: Documenting risk likelihood and impact scores, updated periodically to reflect emerging science and regulatory changes.

- Scenario-Based Stress Testing: Evaluating portfolio resilience under acute shocks (e.g., a 1-in-100-year flood) and transition pathways (e.g., rapid decarbonisation scenarios).

Metrics, Targets and Reporting

- Key Risk Indicators (KRIs): Metrics such as potential stranded asset values, cost of adaptation investments and revenue at risk due to climate extremes.

- Key Performance Indicators (KPIs): Progress against transition targets (e.g., emissions reduction commitments), adaptation milestones and climate resilience certifications.

- Disclosure Frameworks: TCFD-aligned reports, supplemented by quantitative scenario analyses and qualitative narratives.

Embedding into Business Processes

- Capital Expenditure (CapEx) Appraisal: Incorporating climate-adjusted discount rates and resilience premiums into project valuations.

- Supply Chain Risk Management: Mapping supplier exposures to climate hazards and developing contingency plans for critical inputs.

- Insurance and Hedging Strategies: Tailoring insurance covers (e.g., parametric insurance) and exploring climate derivatives to transfer residual risks.

Practical Applications: Case Studies

Banking and Finance

Case Study: Green Project Pooling

An Indian consortium of public and private banks established a shared platform for financing renewable energy, water-conservation and resilient infrastructure projects. By leveraging a centralised climate data repository, the consortium standardised project risk assessments, enabling faster credit approvals and reduced due diligence costs. Portfolio stress tests under a 2 °C warming scenario revealed capital adequacy shortfalls, prompting the banks to allocate an additional 5 per cent of risk-weighted assets towards green lending.

Infrastructure Development

Case Study: Flood-Resilient Highways

A state government used digital twin simulations of a proposed highway corridor to evaluate flood risk under 1-in-50 and 1-in-100-year rainfall events. The analysis identified critical embankment sections requiring elevation and drainage upgrades. Cost-benefit analysis showed that upfront adaptation investments would avert maintenance and reconstruction costs of up to INR 2 billion over 30 years.

Agriculture and Food Security

Case Study: Climate-Smart Farming

An agritech start-up integrated hyper-local climate projections and soil moisture data into its advisory platform for smallholder farmers. By recommending crop varieties, sowing dates and irrigation schedules tailored to projected heatwaves and monsoon variability, the platform improved yields by 15 per cent and reduced water use by 20 per cent, enhancing both productivity and resilience.

Manufacturing and Supply Chains

Case Study: Heat Stress Mitigation

A textiles manufacturer in central India faced rising absenteeism and productivity losses during peak summer months. By analysing high-resolution temperature and humidity data, the company installed evaporative cooling systems in its facilities and adjusted shift schedules. These measures cut heat-related productivity losses by 40 per cent and reduced staff turnover.

Insurance and Risk Transfer

Case Study: Parametric Insurance for SMEs

An insurer launched a parametric insurance product for small and medium-sized enterprises (SMEs) exposed to flood risk. Triggered by rainfall thresholds recorded at local weather stations, the product provided rapid payouts within 48 hours of an event, enabling SMEs to resume operations swiftly. Premium pricing and payout structures were calibrated using probabilistic hazard models from the central repository.

Recommendations for Corporate India

- Invest in Data Infrastructure:

Collaborate with regulators, academic institutions and technology providers to develop or subscribe to centralised climate data repositories. Ensure data platforms adhere to international standards (TCFD, NGFS, ISO 14091) and support interoperability. - Enhance In-House Expertise:

Recruit or upskill climate scientists, data engineers and risk analysts. Establish cross-functional teams combining climate expertise with finance, operations and IT to embed climate considerations throughout the enterprise. - Adopt a Phased Approach:

Begin with pilot projects—such as stress testing a single asset class—before scaling to enterprise risk management. Use lessons learned to refine methodologies, data requirements and governance structures. - Foster Public-Private Partnerships:

Engage with government agencies (e.g., India Meteorological Department), research organisations and industry consortia to share data, best practices and capacity-building resources. Collective action can reduce costs and accelerate innovation. - Integrate into Decision-Making:

Embed climate risk metrics into capital allocation, procurement, supply-chain management and strategic planning processes. Link executive compensation and performance incentives to climate resilience targets. - Leverage Emerging Technologies:

Explore machine-learning models for hazard forecasting, digital twins for infrastructure resilience and blockchain for traceable, tamper-proof data provenance. These technologies can enhance predictive accuracy and operational agility. - Engage Stakeholders Transparently:

Communicate enterprise risk exposures, adaptation plans and progress towards transition goals to investors, regulators and civil society. Transparent disclosure builds trust and can unlock green financing at favourable terms.

The scale and complexity of climate change demand a paradigm shift in how corporate India approaches enterprise risk management. Centralised, credible climate risk data repositories are not merely technical infrastructures; they are strategic enablers that empower businesses to anticipate hazards, quantify exposures and invest judiciously in resilience and adaptation. By integrating high-quality climate data into governance, risk identification and strategic decision-making, Indian corporates can safeguard assets, protect livelihoods and sustain competitive advantage in an increasingly volatile world.

Proactive climate risk management—underpinned by robust data, rigorous analytics and collaborative governance—will be pivotal in steering Corporate India through the climate crisis and towards a resilient, low-carbon future.

The authors Saurav Das and Shubham Thakur are Co-Founders of the Climate Action Front, a climate data repository for efficient decision making, environmental governance and investment for climate-resilient economy.